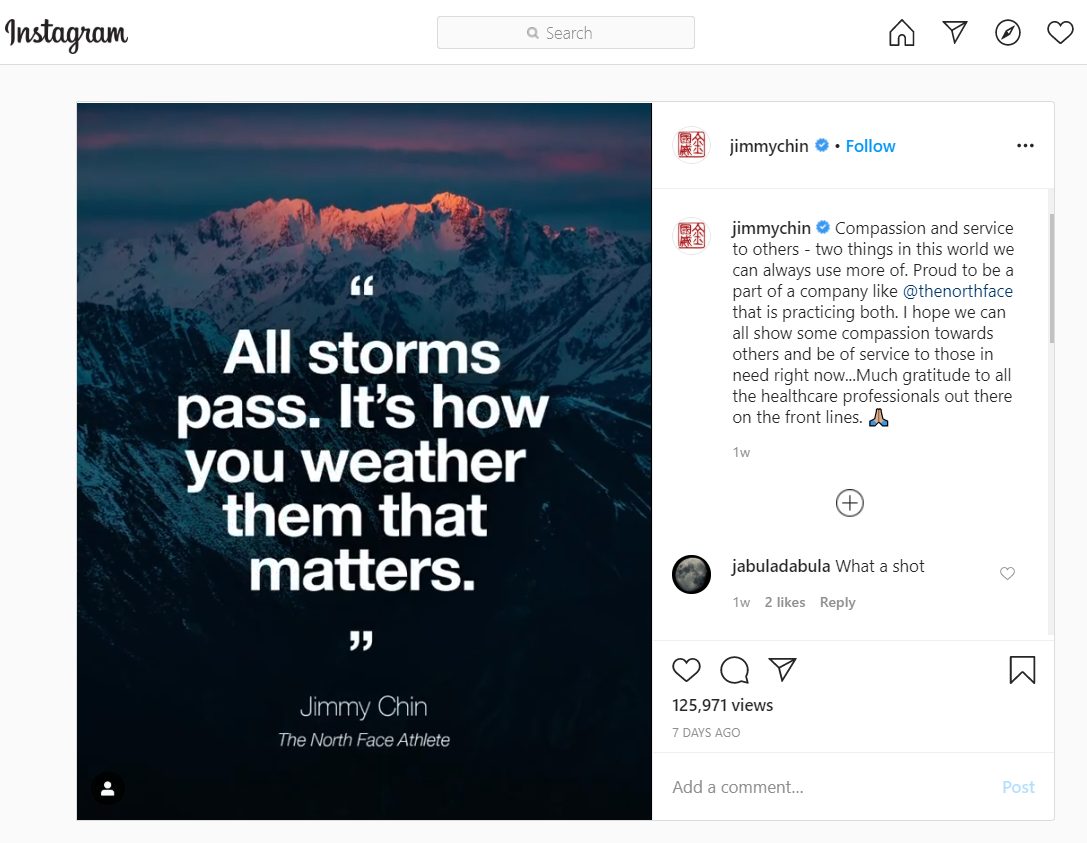

At some point last week, this quote by Jimmy Chin appeared on my Instagram feed.

Jimmy Chin is one of the professional athletes, rock climbers and adventurers that I follow, and he is uniquely qualified to assert that how you weather storms matter most. As a National Geographic photographer, filmmaker and mountain sports athlete, Jimmy is known for his ability to capture extraordinary imagery and stories while climbing and skiing in extremely high-risk environments and expeditions. As a long-time member of The North Face Athlete Team, he has led dozens of expeditions and completed first ascents around the globe, working with the best adventure athletes in the world. If you’ve watched his 2015 film, Meru, which chronicled the first ascent of the “Sharks Fin” route on Meru Peak in the Himalayas, you will understand what I mean.

The quote struck me personally on two very different levels. The first is that in my youth I was (and still am) an avid amateur rock climber. Although I don’t climb frequently today, I do enjoy spending a few hours with my son at our local climbing gym.

Climbing for me is about friendships, loyalty, trust, and the shared experience of being in moments of discovering your limits and pushing past them. There are of course personal storms, albeit mostly mental – like the frustration of not being able to complete a move or fear and trepidation of being outside my comfort zone. All of this is natural for a climber, and they can be managed when your mental energy is focused on solving problems rather than reacting to them.

Jimmy’s quote also stuck me on a professional level. My team and I have been doing a great deal of thinking about the future. Today’s storm will pass, and I believe that we are well positioned to weather it. However, the trillions of dollars of monetary and fiscal interventions that global governments and central banks have poured into their financial systems leads us to think about what risks are over the next horizon. By attempting to mitigate the fiscal and monetary collapse of our economies, governments and central banks have, perhaps, created new risks that are laying in wait. There are no clear answers at this point, however, we have and continue to think through possible outcomes, which I can share.

Markets and Economics

Last week, each of the major indices ended the week with strong positive returns. The S&P 500, in fact, gained the same amount in its best week since 1974. This was amid more than 16 million Americans (10% of the U.S labour force) filing jobless claims over the last three weeks, and more than one million (7.8% of the workforce) doing so in Canada.

So, why are markets rising when the economic data is so terrible? The short answer is that some investors are buoyed by the efforts of central banks to backstop financial markets and provide liquidity so that the current crisis doesn’t become a solvency issue. The title of one research report that came across my desk this week describes the actions of global monetary and fiscal authorities aptly: To Infinity and Beyond. In total, G20 central banks have committed over $5 trillion dollars to ensure the stability of the financial system. In addition, the trillions of dollars in fiscal stimulus to support wages for people working for small and medium-sized enterprises, tax deferrals for businesses and families, and aid packages for workers and low-income households, is equally impressive. In addition, the energy markets were bolstered this past week as OPEC and its allies led by Russia (OPEC+) agreed, in principle, to cut oil output by 9.7 million barrels per day. Finally, the big lever that the market is looking at is the speed at which COVID-19 is coming under control. Overall, markets are being cautiously optimistic as the recent data looks encouraging.

Yet, there is still so much variability in the data, it is hard to make a conclusion one way or another. There is also the news that in South Korea, 91 recovered COVID-19 patients have tested positive again, raising questions about whether this is a re-infection or a re-activation of the virus.

What we’re seeing in the data and how we’re positioning portfolios

“A trend is a trend is a trend, but the question is, will it bend?

Will it alter its course, through some unforeseen force, and come to a premature end?”

- Sir Alec Cairncross

Source: Factset

Does the chart above illustrate a bottom of the market and a bear market rally? Or, is the wisdom of crowd looking past the current data and seeing a return to a solid economic and corporate environment? And, is it a combination of over-optimism due to both central banks and governments being invested “all in” to ensure this situation doesn’t become a depression?

To be honest, it's impossible to tell given the magnitude and nature of the current uncertainties. I am inclined to the latter scenario that markets are getting ahead of the earnings data, but I’m not 100% certain. Rather than making a “bet” on one scenario or the other, it is important for my team and I to be humble about our ability to quickly internalize what all this means, as well as accurately predict what’s still ahead.

Given this uncertainty, we feel that the best positioning for now is this. Maintain our current exposure to both our diversification and equity risk management strategies as they have reduced the magnitude of the negative returns and volatility experienced by our investors over the current period. Given the difficulty in predicting when equity markets will recover, we believe that a well-constructed portfolio consisting of both diversifiers and risk-control strategies is important. These strategies help strike the right balance between protecting investors in the event of further market falls while participating in the upside and generating positive returns as markets recover. As we have discussed previously, at an appropriate time, we will look to trim the exposures to the risk-control strategies to increase equity exposures.

Looking Ahead

When the COVID-19 pandemic subsides, there should be massive increases of improvement in economic data and most risk assets (i.e. credit spreads, leveraged loans, high yield, emerging market and developed market equities). At the same time, volatility will subside, similar to what we saw after March 2009, when the Great Financial Crisis ended. Commodities should also see a rebound, but this will only be sustained if the economic bounce back continues - meaning demand must overwhelm supply on a sustained basis. The USD should weaken providing global support to risk assets. The challenge will be assessing and overcoming the damage done by COVID-19 to businesses and the structural framework of the global economy, which could impede an immediate recovery. The recovery may have some false starts and may take a little longer than some of the sharp rebounds in the past.

Some market participants believe that once the COVID-19 pandemic passes, the enormous fiscal deficits, the concerns about debt sustainability, and higher inflation will push interest rates up, potentially, above the pre-pandemic levels. Others believe that a combination of a saving glut and yield curve control by central banks will keep interest rates low long after the pandemic has passed.

We believe that fiscal and monetary stimulus, will be sufficiently stimulative in the short term to soften the demand shock. However, as demand recovers, is there reason to fear that all this stimulus causes inflation to rise beyond the target range of 2-3%? Our thought is that while there is a risk of inflation, lessons from the post-2008 Financial Crisis show that the key measure is how quickly money is turned over, something known as the velocity of money. Without that velocity, money just sits in people’s bank accounts, collecting scant interest and, potentially, creating future asset bubbles. Instead, we believe inflation only becomes a problem if there is a will to create it by governments. Consumer demand by itself is not enough. Instead, let’s focus on a potentially more effective source of inflation: nationalism. Inflation may come if U.S. policymakers take a more hawkish stance on Chinese trade, whose competitive advantage allows them to produce goods at significant discounts to American-made manufacturing. If we couple all of the fiscal and monetary stimulus with new policies to repatriate production from China and other offshore sources, then we could potentially see an unhealthy amount of inflation.

Particularly troublesome is the future impact of the global supply chain. The virus has exposed the lack of supply-chain redundancy and the fragility of just-in-time perfection. China represents 35% of global manufacturing output and is the world’s largest exporter of goods -- totaling ~$2.5 trillion in 2018 (source: McKinsey). These goods include 40% of all exports of textiles/apparel, 26% of furniture and 55% of all computers (source: UBS). And the country produces 80% of global smartphones and tablets. There’s still no single nation that can match China’s advantages as a manufacturing base and it is uniquely integrated in the global economy at the center of a complex network of supply chains overwhelmingly optimized for efficiency, and now we are realizing, not for resilience.

The rise of populism, too, may exacerbate these conditions in developed nations as countries look inward rather than outward. The virus’s disruption of supply chains not only unhinges imports but also raises national security concerns. Even after the pandemic subsides, look for more pressure from the U.S. and other countries for more reliable sources of goods, amongst other protectionist measures. Domestic producers will benefit. The results will be lower global efficiency and slower economic growth.

We believe that there are several possible implications with the rise of populism and the potential reorganization of global supply chains to be more resilient but less efficient and hence cost effective for the consumer. How these two themes interact will have significant implications for global growth and investment opportunities. Some of the implications could be:

- Closing borders will only slow global economic growth further. Prior to the crisis, global economic growth recorded its weakest pace since a decade ago. Rising trade barriers and associated uncertainty weighed on business sentiment and activity globally.

- Protectionism will make many goods and services more expensive.

- Rising wages will make investment assets less profitable.

- Greater dispersion in growth rates will mean that individual security selection becomes more important.

- Uncertainty will rise, as will market volatility. This will be both good and bad. Rising volatility is uncomfortable, as we are all aware, but it creates dislocations that disciplined investors can capitalize on.

- Inflation is a big question mark. Rising inflation and low economic growth is bad. Rising inflation and rising economic growth is not so bad, so long as the inflation rate runs parallel to the economic growth rate and the two do not cross.

What does this mean for our portfolios?

For the nearer term, I believe that in a well constructed portfolio it makes sense to barbell your approach with value and growth stocks to have broad diversification. Value names have been significantly beaten up in this downturn, which makes sense as they are usually more indebted, have high fixed assets and trade with a higher beta during large economic growth shocks. Coming out of the crisis, we expect value stocks to do well because they are highly levered to economic growth changes. The Counsel Strategic Portfolios and most of the IPC Private Wealth Portfolios are barbelled this way in their equity positions.

Lastly, let’s look at fixed income. A rising rate environment does not necessarily mean that one should abandon bonds. Impacts to the bond component of your portfolio will be highly dependent upon the following variables:

- the starting rate level

- the number, magnitude, and duration of interest rate hikes

- the starting level of credit spreads

- the steepness of the yield curve.

Also, different classes of bonds are more sensitive to rising rates than others. Active management of fixed income strategies will be key to successfully navigating through such an interest rate environment. Our fixed income managers have the experience, breadth of opportunity, and flexibility to do so.

Final Thoughts

You are likely feeling a bit claustrophobic right now. I know I am. Although my days are filled with the daily activities of life, they are all in the confines of our four walls. I long to be outdoors, even on the smallest outdoor adventure, but for now I will have to satisfy myself with living vicariously through the adventures of Jimmy Chin and other professional outdoor athletes. I think I will re-watch The Dawn Wall and Free Solo, two inspiring movies about Tommy Caldwell & Ken Joregson (The Dawn Wall) and Alex Honnold (Free Solo). These are stories about obsession, determination, human physical and mental potential. As someone who is concerned about managing risk under uncertainty, they are also stories about how people perceive and manage risk. Perhaps there is a future weekly letter that examines these ideas?

The duration of this storm is still unclear. Likewise, we can’t pin its outcomes with any certainty just yet. However, the fog will lift with time. For now, like Jimmy Chin, we must be patient as we weather the storm. We have conviction in our approach, and we will make adjustments to our asset allocation strategies as things start to clear up. We recommend that you too keep your plan in mind, focus on the things that you can control. Above all, be patient and seek the guidance of your advisor, when you need advice. As Jimmy says, “All storms pass. It’s how you weather them that matters.”

Until next week, stay safe and be well.

Corrado Tiralongo

Chief Investment Officer

Counsel Portfolio Services | IPC Private Wealth

Click Here to Read Our Forward-Looking Statements Disclaimer